This veteran system trading broker analyzed his best long-term clients and their trading strategies to find the ultimate answers to success

A complete beginners road-map to successful systematic trading. A veteran broker shares deep insights from executing almost 1,000 strategies during his career – unleashing what works, what doesn’t, and what’s the quickest path to success.

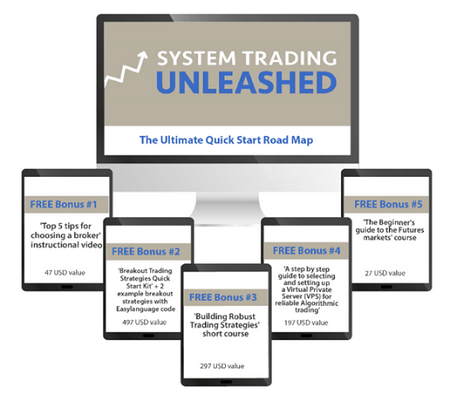

Today, Martin finally reveals the ultimate road-map to system trading in his new program “System Trading Unleashed”

Here’s what you’ll discover in System Trading Unleashed:

Module #1: Selecting the ‘Markets and Timeframes’ the most profitable traders use

- Which markets are the best to trade and which ones you should completely avoid,

- The most popular timeframes used by successful traders,

- How to choose a trading style that suits you and the markets you want to trade. So many beginning traders get this wrong, and they suffer for it.

Module #2: Unleashing ‘Technology’ so you don’t waste money on hardware and software you don’t need

- The most popular software the majority of traders use and the best way to get started,

- What type of computer you need. This includes speed, memory, internet connection and other aspects you need to consider to have a reliable trading machine,

- Can you trade using a home PC, or do you need something else, like a Virtual Private Server?

Module #3: Unleashing the ‘Best Performing Systems’ that keep making money consistently over many years

- What all the best performing strategies have in common, so you can do the same,

- How to keep trading strategies fresh, and do we really need to re-optimize them?

- How long trading strategies can last, and how much money they really make.

Module #4: Unleashing the ‘Worst Performing Systems’ so you know exactly what not to do, saving the money in your trading account

- What the worst performing strategies have in common,

- Can we spot the flaws in trading strategies before they lose too much money?

- The top mistakes strategy developers make that cause poor performing systems.

Module #5: ‘Behind the Scenes’ tips to knowing exactly how much money you need to get started

- How much money is really required to start trading,

- When to switch trading strategies on and off and what to do if a trading strategy goes bad,

- Why some traders still lose money even when they have a profitable system.

Module #6: Creating ‘Portfolios’ of strategies for consistent profits and lower drawdowns

- Why traders need a portfolio of strategies for consistent profits and long-term success,

- The best way to approach portfolio construction – do it wrong, and you could blow up your trading account!

- How to combine strategies into a powerful portfolio to reduce drawdowns and create a smooth equity curve.

Sales Page

This content is locked

Login To Unlock The Content!

This content is locked

Login To Unlock The Content!